What India needs is a robust culture of scientific innovation and creative ideas.

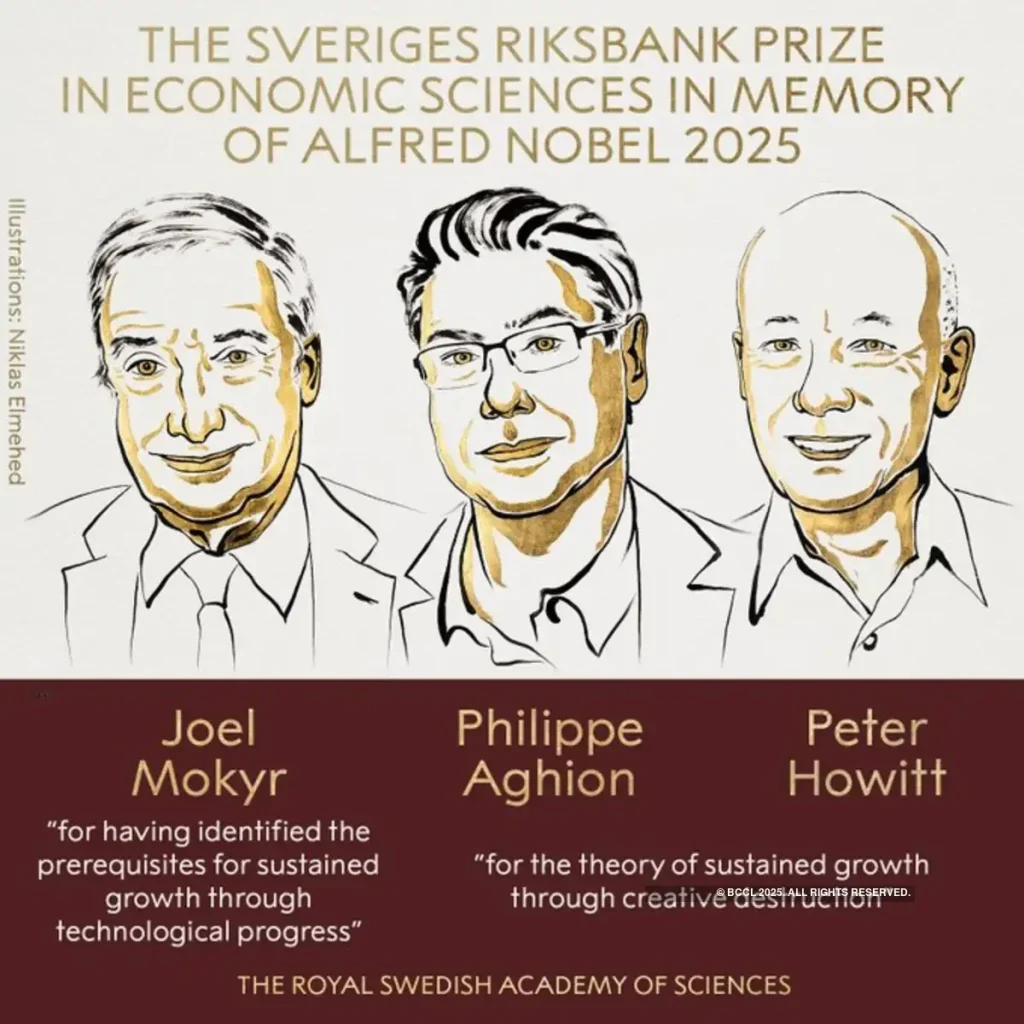

science and engineering need to be integrated into a productive feedback loop, which has been a structural weakness of the Indian knowledge system”, gains sharper meaning when seen in the context of the 2025 Nobel Prize in Economics, awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt for deepening our understanding of how knowledge, innovation, […]

What India needs is a robust culture of scientific innovation and creative ideas. Read More »